As the world continues to develop, investment will be crucial in controlling climate change and protecting our environment.

Battling climate change through mitigation and adaptation is a capital intensive endeavor, so shifting the mindset towards placing ESG (Environmental, Social, Governance) integration alongside returns will be essential in the fight to save the environment. Fortunately, as some of the world’s largest companies and leaders have taken notice, that shift has already begun as investment into ESG is on pace to double each of the last 4 years.

What is Green Finance?

Green Finance includes the financial arrangements that are specific to the use for projects that are environmentally sustainable or that adopt the aspects of climate change.

- Projects include production of energy from renewable sources, clean transportation, green buildings, waste management, and sustainable land use.

Different types of investment and how they help Climate Change:

Equity

What is an equity investment?

An equity investment is an investment in shares of a publicly owned company.

How can it be implemented in Emerging Markets?

These investments in companies in emerging markets allow them to fund different projects and operations. With individual stocks, investors can invest in individual companies that they believe have value.

India: click here to learn more about some of India’s top solar stocks.

Fixed Income

What is a Fixed Income Investment?

Fixed Income Investments involve the purchasing of bonds that pay out fixed interest over a set period of time. These are generally considered to be lower risk investments than both public and private equity.

How is it implemented in emerging markets and how can it help climate change?

The governments, companies in these emerging markets , or global companies and firms can issue bonds that can be used for investment in climate related projects.

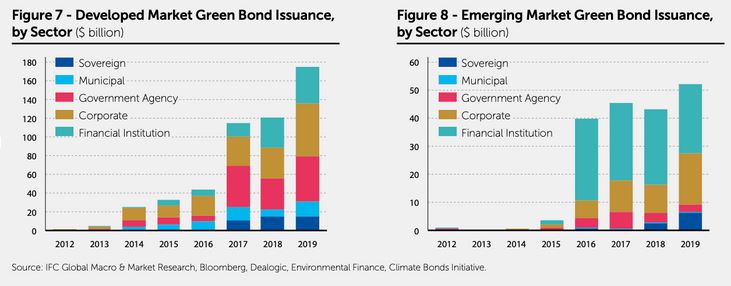

Green Bonds

- Green bonds are fixed-income instruments that are earmarked to raise money for climate and environmental projects.

- The bonds are usually asset-linked and backed by the issuing entity’s balance sheet so they generally carry the same credit rating as their issuers’ other debt obligations.

Private Equity

What is Private Equity?

Private equity includes investing in companies that are not publicly traded with the goal to create higher return than publicly traded assets.

How can Private Equity in emerging markets help climate change?

When a PE firm purchases a stake in a company, they use their expertise and resources to improve performance and increase the value of the company. When investing in companies whose goal is to mitigate or adapt to climate change, such as a producer of solar panels, increasing production would result in more solar panels and clean energy sources.

Real Estate

Development of Green Buildings

- Investment into the creation of buildings that run more efficiently and use less energy than traditional buildings

- Demand and regulations requiring green buildings are increasing

- IFC Reports: Green Buildings are higher value, and lower risk due to lowering energy consumption, lower operational cost, higher sale premiums and they attract/retain more tenants

Risks with Real Estate

- Much more illiquid investment

- Demand and regulations requiring green buildings are increasing

- Green Finance in Emerging Markets

How can it be implemented in emerging markets?

It is estimated that there is a $24.7 trillion investment opportunity by 2030.

- As population and development grows, the demand for new buildings for living and retail boom.

- Some advantages include lower long-term operating and maintenance costs, lower default rates, decreased odds of becoming a stranded asset, and potentially higher returns on investment.

- Green buildings can…

- Decrease operational costs by up to 37%,

- Achieve higher sale premiums of up to 31% and faster sale times

- Have up to 23% higher occupancy rates

- Have higher rental income of up to 8%

For more information, check out the International Finance Corporation (IFC)’s report Green Buildings: A Finance and Policy Blueprint for Emerging Markets.

Infrastructure

What would an investment in infrastructure look like in emerging markets?

- Investment into smart water and waste management.

- Investments into transportation systems such as ports or trains, which use less carbon that cars.

- ROI for infrastructure investments.

Microfinance

What is Microfinance?

- Microfinance involves small loans and grants given to those who lack access to traditional financial institutions.

- It helps low-income households strengthen their livelihoods and allows small enterprises to enter new markets.

- It is green in of itself, in that it promotes businesses that can be sustained indefinitely.

- Sustainability is generally a precondition to awarding loans.

How is it implemented in emerging markets?

- Emerging markets generally need the most financial help. Those living in poverty will feel the effects of climate change the most. Without action, the effects will push an additional 100 million people into poverty by 2030.

- Investment into climate smart farming.

Financial Returns?

World bank statistics show that 97% of microloans are repaid.

Case Studies

Blackrock Sustainable Investment Opportunities

Equity

- BGF Sustainable Energy Fund

- Invests at least 70% of its total assets in the equity shares of sustainable energy companies.

- BGF Future of Transport Fund

- Invests at least 70% of its assets in shares of companies that work to develop future transportation technology, especially those working on the transition to renewable energy in vehicles.

- BGF Nutrition Fund

- Invests at least 70% of assets in shares of companies that combat global problems in the sustainability of nutrition and agriculture.

- BGF Circular Economy

- Invests 80% of assets in the equity of companies that contribute to the advancement of the “Circular Economy”- the concept to minimize waste by considering full life cycle of materials.

Fixed Income in Emerging Markets

- BGF ESG Emerging Markets Bond Fund ; BGF ESG Emerging Markets Local Currency Bond Fund ; BGF ESG Emerging Markets Corporate Bond Fund ; BGF ESG Emerging Markets Blended Bond Fund

- Will invest 70% of assets in JP Morgan ESG Emerging Bond Index Global Diversification in emerging markets.

- 30% will be invested into Index securities based on the investment advisors analysis of the ESG characteristics of the Issuer amongst other characteristics.

Multi-Asset

- ESG Multi-Asset Fund

- ESG focused investments that invests globally in the full spectrum of permitted investments including equities, fixed income transferable securities, units of undertaking for collective investment, cash, deposits, and money market instruments.

- Tactical Opportunities Fund

- BSF Style Advantage Screened Fund

- Uses full spectrum of permitted investments, yet excludes issuers which have exposure to breaches in one or more of the ten UN Global Compact Principles.

International Finance Corporation (IFC)

- Created to advance economic development and improve the lives of people by encouraging the growth of the private sector in developing countries.

- Mobilizing investors, creating markets and sharing expertise by investing in companies:

- Loans, equity investment, debt securities and guarantees.

- Mobilizing capital from lenders and investors through loan participation, parallel loans and other means.

- Advising businesses and governments to encourage private investment and improve the investment climate.

- Mobilizing investors, creating markets and sharing expertise by investing in companies:

- IFC analysis shows a $29.4 trillion climate investment opportunity by 2030 in six urban sectors:

- Green buildings, public transport, improved management of water resources, renewable energy, and waste management.

- IFC helps the private sector invest more in industries that will improve the climate and support countries as well as yield good returns on investment.

- Green Building Case Study

- Jeroen Biermans, the general manager of WDP, wanted to develop green buildings in the outskirts of Bucharest.

- IFC provided a green financing package for e205 Euros to fund the project, the first IFC Green Loan to the private sector in Eastern Europe and Central Asia region.

- The financing is expected to save 12,083 tons of carbon dioxide per year.

- On average IFC makes a 6.8% return on capital per investment.

Top Green Investment Opportunities

Source

Water

Wind Power

Solar Power

Pollution Control

Green Transportation

Waste Reduction

Organics: Farming

Aquaculture

Geothermal